Your choices

Introduction

DC Start

In DC Start, your account is automatically invested in the Lifetime Pathway fund. Your target retirement age is your state pension age. You don't have to make any investment decisions.

If you're in DC Start and you'd like to choose your own investments or change your target retirement age, you'll need to switch to DC Core. You can do this by completing the DC Core Option Form and returning it to Nestlé Pensions.

DC Core

In DC Core you can choose how your contributions are invested. You can put all your contributions into either:

- the Lifetime Pathway fund; or

- any combination of our selection of individual self-select funds.

If you don't choose how to invest your contributions, they will be invested in the Lifetime Pathway fund. While we think this fund will meet the investment needs for most of our members, it might not be right for everyone. You'll need to think about whether it's right for you and what age you'd like to retire at - this is known as your target retirement age.

The Lifetime Pathway fund

In the Lifetime Pathway fund, your contributions are automatically invested and switched to more stable investments over time as you approach your selected retirement date.

This switching takes place in three phases:

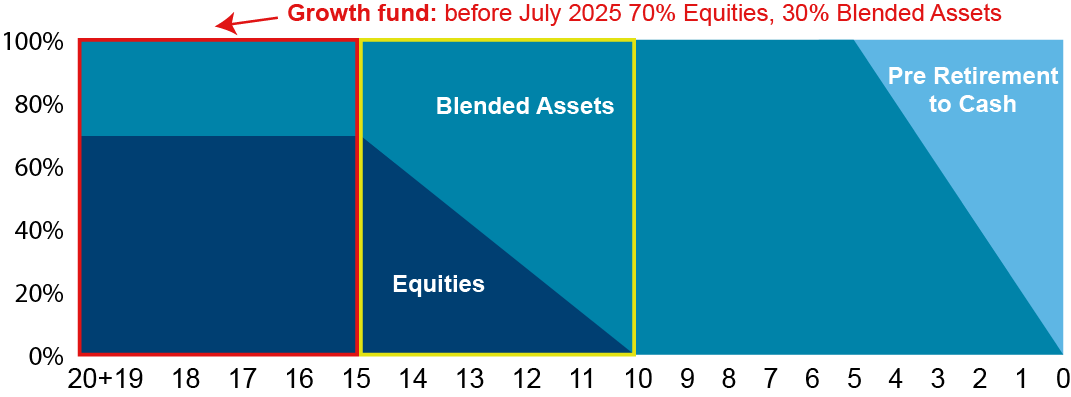

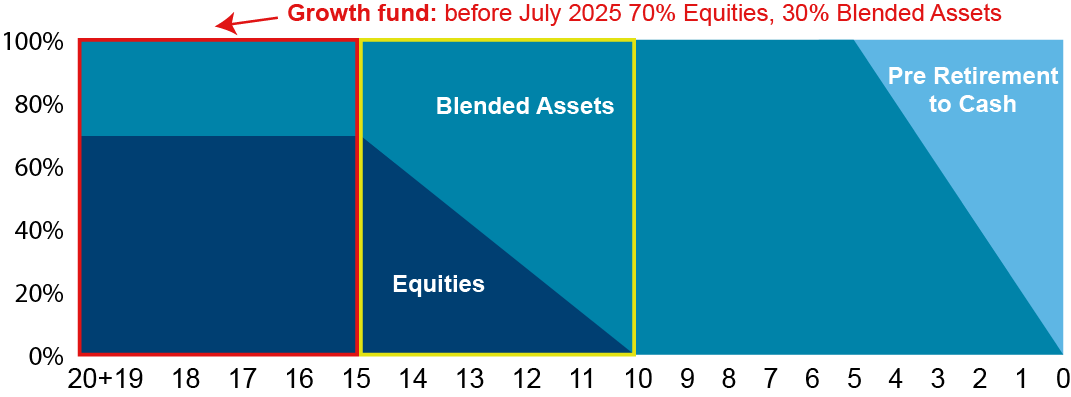

1. Growth

Over 15 years from target retirement age.

Aim:

In this phase the aim is to provide long term returns to grow the value of your investments.

Made up of:

The underlying funds invest in 100% shares.

Funds used:

Growth fund.

2. Consolidation

From 15 years to 5 years from target retirement age.

Aim:

In this phase the aim is to keep a level of growth with your investments and to start to protect the value of the funds you have already built up. Your DC account will automatically progressively switch from the Growth fund into the Blended Assets fund between 15 years and 10 years from retirement and will stay fully invested in the Blended Assets fund until you reach five years from retirement.

Made up of:

The underlying funds invest in a broad range of assets including shares, bonds, property, asset-backed securities and cash.

Funds used:

Equities and Blended Assets funds.

3. Pre-retirement

Less than 5 years from target retirement age.

Aim:

In this phase the aim is to protect the value of the funds you have already built up, while continuing to provide some growth. Your DC account will automatically progressively switch into cash as you approach retirement.

Made up of:

The underlying funds of the Pre-Retirement to Cash fund invest in cash and other money market instruments that are similar to cash with low risk of loss.

Funds used:

Blended Assets and Pre-retirement to Cash funds.

Automatic switching and your TRA

This graph shows the make-up of the underlying funds in the Growth and Consolidation phases:

Changing your target retirement age

If you're invested in the Lifetime Pathway Fund, your target retirement age is the age you've told us you'd like to retire at. We use it to work out when we need to start switching you out of higher-risk investments.

You can see how your investments gradually start to switch into more stable funds as you approach your target retirement age in the 'Automatic switching and your TRA' graph.

Your target retirement age doesn't have to be the same as your normal pension age in the Fund.

If you change your target retirement age while you're in the consolidation or pre-retirement phases shown above, we'll need to adjust the ratio of your higher-risk to stable investments to reflect how close you are to your new target retirement age. We do this by buying and selling investments until you have the right mix of higher-risk and stable investments again.

You can change your target retirement age by completing a Target Retirement Age Change Form and returning it to Nestlé Pensions. You can make this change whenever you like, but we process these forms every February, May, August and November.

You can also complete this form online by logging into your Online Account.

Lifetime Pathway fund charges

During the three phases of the Lifetime Pathway fund (shown in the graph above), the charges (or “Total Expense Ratio”) are currently:

Growth phase

Total expense ratio: 0.162%

Consolidation phase

The total expense ratio increases from 0.162% to 0.32% between 15 and 10 years before target retirement age as your DC account gradually moves into the Blended Assets fund. The total expense ratio stays at 0.32% from 10 to 5 years before target retirement age.

Pre-retirement phase

The total expense ratio decreases from 0.32% to 0.15% from five years before target retirement age as your DC account gradually moves into the Pre-retirement to Cash fund.

Self-select funds

If you'd prefer to select your own investment strategy, you can choose from our self-select fund options below. These funds don't automatically move your investments into lower-risk investments as you approach retirement, but you can decide to change your investments yourself. For more information, see Changing your funds.

Equities

Cash

Blended assets

Corporate bonds

Ethical consolidation

Ethical growth

Pre-retirement to annuity

Pre-retirement to cash

Property

Shariah

Fund reviews

From time to time, we (the Trustees) – through the Defined Contribution Committee and with the support of the investment advisers – may make changes to the underlying funds in the Lifetime Pathway fund and the self-select fund range.

This may be because a particular fund isn't performing as well as we expected, or to reduce the costs and charges in a fund.

You can find an overview of the latest changes to the funds below.

Changes to the funds

Changes made in 2025

In July 2025, the Defined Contribution Committee (DCC), with advice from their investment advisers, made some changes to the Lifetime Pathway fund.

The changes are designed to maximise investment growth up to 15 years before retirement and into the Consolidation phase of the Lifetime Pathway fund. Broadly, they consist of adjusting the allocation across the existing equity funds so that the Growth phase is now fully (100%) invested in equities (shares). In turn, this has enhanced the geographical diversification of the fund.

During the switch between the Growth and Consolidation phases, 5% of your savings will move each quarter from the Growth fund to the Blended Assets fund. So, at 10 years before your Target Retirement Age, 100% of your savings will be invested in the Blended Assets fund as shown below.

Changes to the Lifetime Pathway: Growth phase

Previously, the 'Growth phase' was made up of:

- 70% Equities fund

- 30% Blended Assets fund

From July 2025, the Growth phase is made up of:

- 100% Equities fund

This will:

- Increase the overall allocation of the Growth fund which will now be made up of 100% equities (shares),

- Enhance the geographical diversification of the Growth fund, and

- Invest in different types of equities with the aim of maximising the potential returns.

Changes to the 'Growth phase' underlying funds:

Underlying funds in the 'Growth phase' before July 2025:

- 6.75% RobecoSAM Global SDG Credits

- 6.75% PIMCO GIS Income Fund

- 8.70% Loomis Sayles Global Emerging Markets Equity Fund

- 38.90% BlackRock ACS World ESG Screened and Optimised Equity Tracker Fund

- 38.90% BlackRock ACS World Multifactor ESG Screened and Optimised Equity Tracker Fund

Underlying funds in the Growth phase after July 2025:

- 45% BlackRock ACS World ESG Equity Tracker Fund

- 45% BlackRock ACS World Multifactor ESG Equity Tracker Fund

- 10% Loomis Sayles Global Emerging Markets Equity Fund

You can read more about the fund factsheets on the Investment performance page.

Moving from 'Growth phase' to 'Consolidation phase'

The transition from 'Growth phase' to 'Consolidation phase' will now follow this path:

- 15 years before your target retirement age, your savings will start to move from the Growth fund to the Blended Assets fund.

- Each quarter, 5% of your assets will switch from the Growth fund to the Blended Assets fund. This process will take five years.

- At 10 years before target retirement age, your assets will be invested 100% in the Blended Assets fund.

There is no change to the move to 'Pre-retirement to Cash' which starts once you're five years before target retirement age. This approach ensures that equity exposure, which generally generates higher investment returns, is maintained longer, avoiding reducing too early which could compromise growth opportunities.

Changes made in 2024

In early 2024, following a review in 2023, the Defined Contribution Committee made some changes to the underlying funds in the Lifetime Pathway fund and some of the self-select funds. This was because some of the funds weren't performing as well as we expected, but also because new funds were available on the Fidelity platform.

Change to the Equities fund

The key change to the Equities fund was to replace a passive emerging markets equity fund (State Street Emerging Markets Screened Equity fund) with an actively managed emerging markets fund (Loomis Sayles Global Emerging Markets fund).

The Equities fund was previously made up of:

- 43% Blackrock World Multifactor ESG Equity fund

- 43% Blackrock World ESG Equity fund

- 14% State Street Global Advisers Emerging Markets Screened Equity fund

Following the review, the Equities fund is now made up of:

- 45% Blackrock World Multifactor ESG Equity fund

- 45% Blackrock World ESG Equity fund

- 10% Loomis Sayles Global Emerging Markets Equity fund.

These changes reduced the fees in the Equities fund from 0.18% a year to 0.16% a year.

Changes to the Blended Assets fund

The Blended Assets fund was also reviewed and the underlying funds restructured to the following:

- 22.5% PIMCO GIS Income fund

- 22.5% Robeco Global SDG Credits fund

- 20.5% Blackrock World Multifactor ESG fund

- 20.5% Blackrock World ESG fund

- 10% L&G 70:30 Hybrid Property fund

- 5% Loomis Sayles Global Emerging Markets Equity fund

These changes reduced the fees in the Blended Assets fund from 0.59% a year to 0.32% a year.

Changes to the Pre-retirement to Cash and the Cash fund

The underlying cash fund was changed from:

- 100% L&G Cash fund

To

- 100% Blackrock Liquid Environmentally Aware fund (LEAF)

These changes resulted in a slight reduction in the fees of the Pre-retirement to Cash and Cash funds from 0.16% a year to 0.15%.

Change to the Corporate Bonds fund

The underlying bond fund was changed from:

- 100% Fidelity UK Corporate Bond fund

To

- 100% Robeco Global SDG Credits fund

This change reduced the fees in the Corporate Bonds fund from 0.42% a year to 0.32% a year.

Changes to the Ethical Growth fund

The Ethical Growth fund was previously made up of:

- 70% L&G Ethical Global Equity fund

- 15% L&G All Stocks Gilts fund

- 15% L&G All Stocks Index Linked Gilts fund

Following the review, the Ethical Growth fund is now made up of:

- 100% L&G Ethical Global Equity fund

This change resulted in a small increase in the fees in the Ethical Growth fund from 0.23% a year to 0.25% a year.

Changes made in 2021

Changes to the Blended Assets fund

In September 2021 we replaced one of the underlying funds in the Blended Assets fund. This was because it wasn't performing as well as we expected.

If you are in the Lifetime Pathway, or have invested your pension savings in the Blended Assets self-select fund, this will affect you.

The Blended Assets fund was previously made up of:

- 50% Invesco Global Targeted Returns Fund

- 50% Schroders Diversified Multi Asset Fund

Following the review, the Blended Assets Fund is now made up of:

- 37.50% Schroders Diversified Multi Asset Fund

- 12.90% SSGA Global Multi-Factor Strategy

- 2.10% SSGA Emerging Markets Equity Index Fund

- 38.13% PIMCO GIS Income Fund

- 9.37% L&G All Stocks Gilt Index Fund

As result of this change we hope to deliver better outcomes for our members, by providing:

- Lower investment fees – so that you pay less costs and charges during the time that your pension savings are invested in the Fund.

- Investment returns that are the same or better but that have a lower risk profile.