How DC investing works

Do I have a DC account?

DC Start and DC Core are our defined contribution (DC) sections of the Nestlé UK Pension Fund.

If you joined Nestle after July 2016, you will be building up pension benefits in DC Start or DC Core.

If you joined Nestle before July 2016, you’re likely to be building up pension benefits in DB Core or DB CorePlus. Even if you’re a DB Core or DB CorePlus member, you may still save into a DC Core account. This may be because you pay ‘overcap contributions’ to DC Core once you earn over the pensionable earnings cap for the scheme year. Or, you may make additional voluntary contributions (AVCs) to DC Core either as regular or as one-off payments from your salary.

You can find out more about the different sections of the Fund.

Not sure which section you’re in?

DC Start and DC Core

As a member of DC Start or DC Core, you have an individual account, which is invested with the aim of growing its value (through investment returns).

In DC Start, your account is automatically invested in the Lifetime Pathway fund, so you don’t have any investment decisions to make. The money from your account goes into the Lifetime Pathway and we assume that you will save until your state pension age. You can read more about the Lifetime Pathway in 'Your Choices'.

In DC Core, you can choose how your account is invested.

DB Core and DB CorePlus

If you are a member of DB Core or DB CorePlus and you:

- earn more than £51,647 (the pensionable earnings cap); or

- pay additional voluntary contributions (AVCs)

You will also have a DC Core account, and you can choose how you want to invest your savings.

How DC investing works

No matter how you save into our DC sections, they work in the same way – you have an account that you save into and the money that you save into this account is invested.

If you’re a member of DC Start, we invest your savings in the Lifetime Pathway Fund, and if you are a member of DC Core, make AVCs or are a DB Core or DB CorePlus member paying ‘overcap’ contributions, you have a choice of where your savings are invested. You can either choose to invest in the Lifetime Pathway, or you can choose to invest in our self-select funds. And throughout the year you can change how your DC Core account is invested if you want to. We process these requests every three months so your change will take effect from the next February, May, August or November.

You can find out more about the Lifetime Pathway fund and the self-select funds.

Your savings stay invested until you retire, or until you transfer them into a similar type of pension fund.

Where is your DC account held?

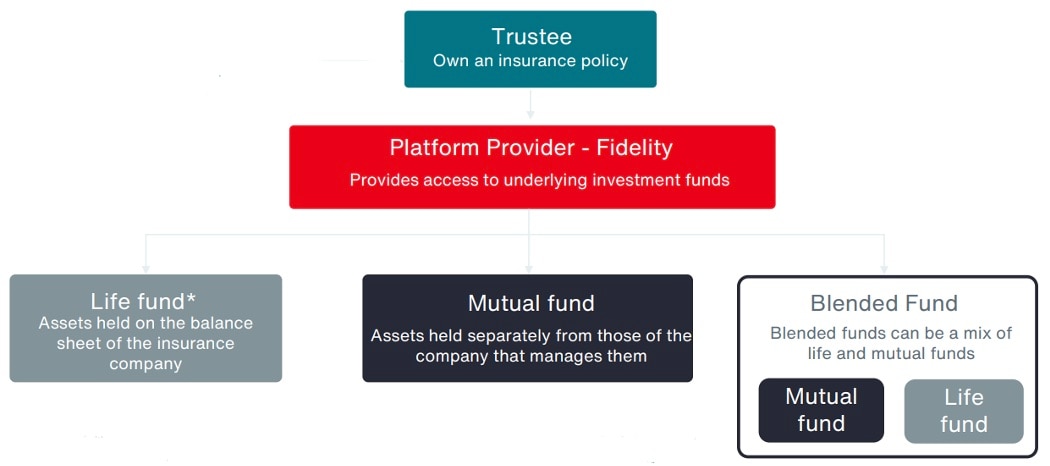

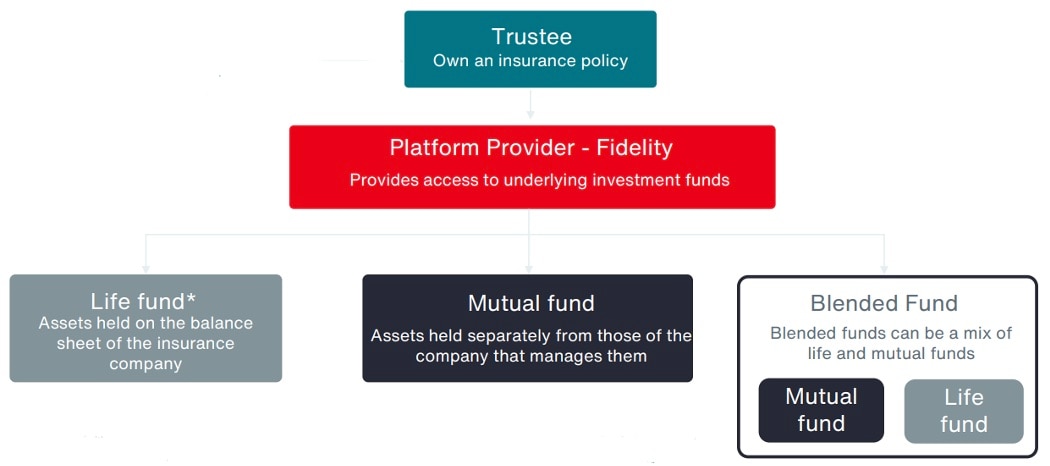

The underlying funds in the DC accounts are held on an investment platform managed by Fidelity International.

Through an insurance policy held by our pension fund, Fidelity manages all of the operational aspects in relation to where we instruct them to invest or divest money on behalf of our members.

Risk and reward

Your attitude to risk is important when deciding how to invest your DC Core account.

Usually the higher the risk, the more you can potentially get back from your investments. But, as the name suggests, with higher-risk investments you are also more likely to lose out, especially in the short term. Lower-risk investments usually give more predictable returns. However, over the long term these are likely to be lower than returns from higher-risk investments.

There are different types of investment risk, which include:

- the risk that your investments will go down in value, or not do as well as expected;

- the risk that any overseas investments will lose value due to the currency they are held in. For example, if the pound gets stronger against the euro, European investments will lose value to a UK investor;

- the risk that your investment returns will lose value in ‘real terms’. This means that they grow less than inflation does; and

- the risk that the return on your investments will be lower than the cost of managing them. This cost is often referred to as the annual management charge.

Your age and how close you are to retirement could also affect your attitude to risk.

If retirement is quite far away, you may be happy to accept a higher level of risk in the hope of higher investment returns in the longer term, as you’ll have time to wait for markets to recover if the value of your investment falls.

If you’re nearer to retirement, you may want to protect the value of your account, rather than trying to grow it, so lower-risk funds might be better for you.

The value of investments can go down as well as up

As with any investments, the value of your account depends on the performance of the things, or ‘assets’, that your money is invested in. If these assets perform well, then you may receive good ‘investment returns’ which means that the value of your pension savings account could increase. If the assets don’t perform well, then you may receive poor investment returns which means that the value of your pension savings could decrease.

By law, we’re not allowed to give you advice about your investment choices. If you’d like to discuss your options, you should contact a financial adviser regulated by the Financial Conduct Authority. You can find one near you on unbiased.co.uk.

What does it cost?

To cover the cost of managing your investments, a percentage of the total value, known as the annual management charge, is automatically taken out of your DC account via an adjustment to the unit prices. Other charges may also apply to certain funds. The annual management charge plus any other charges give the total fund charge, which is known as the total expense ratio.

This can vary slightly each quarter depending on how the underlying funds perform and the level of expenses involved in managing them. Please refer to the fund factsheets for the current total expense ratio.